For businesses that rely on subscription revenue – SaaS companies, membership services, etc – Monthly Recurring Revenue (MRR) is the first metric that comes to mind.

More recently, pricing strategies that depend – at least in part – on “pay for what you use” models have become increasingly popular because they can more effectively align what a customer pays with the value they receive from your product or service.

While these models go by many names, including “metered billing,” “usage-based pricing,” or broadly “consumption-based pricing,” they all mean that a customer who uses a product frequently pays more than someone who is only an occasional user.

We’ll show you how HubSpot can be your ally in not only customer relationship management, but also to track and report monthly revenue in an ever-evolving landscape.

Cracking the Code of Metered Billing

Metered billing means you only pay for what you use – a concept embraced even by tech giants like AWS, GCP, and Azure. It's like paying for exactly how much pizza you eat or gas you put in your car – no more, no less.

As you navigate the dynamic world of MRR, understanding incremental usage or metered billing is your secret weapon. You can use this model to your advantage, tailoring your pricing strategy to reflect the true value your customers get from your services based on actual customer usage that fosters a fair and transparent model while providing your business a strategy for growth that is future-proof.

Understanding MRR in a Metered World

As metered billing becomes part of the MRR world, a mutually beneficial relationship occurs.

MRR functions like the steady flow of transactions in a bank account, maintaining automatic consistency.

On the flip side, metered billing adds a valuable rhythm to the overall finances, making a balance between stability and change in revenue. This dynamic interaction between MRR and metered billing highlights the need for adaptability and resilience in the SaaS evolution.

Understanding the Financial Impact of Metered Billing on MRR

So, let;s talk numbers – the good stuff! Understanding how metered billing or usage-based billing impacts Monthly Recurring Revenue (MRR) is crucial for businesses, especially from a financial perspective. Metered billing models, where charges are based on actual usage, introduce a bit of variability into your MRR calculations.

- Financial Considerations

- The base charge is your steady, reliable income source.

- Usage charges bring flexibility, allowing businesses to adapt to changing customer behaviors and usage patterns.

- Impact on MRR Calculation

- MRR comprises both the base charge and relevant usage charges for the month, providing insights into revenue trends, customer behavior, and growth potential.

- This comprehensive approach ensures a holistic understanding of the financial impact of metered billing, however it's important to remember that this introduces a natural flux month over month due to variable usage charges.

- Strategic Insights

- Monitoring MRR in the context of metered billing helps you understand the overall revenue trend, the impact of customer behavior on charges, and the potential for revenue growth. It's like having a crystal ball for your business's future.

- Forecasting and Planning

- Leverage MRR insights to forecast revenue, make informed decisions about pricing structures, and plan for future scaling or adjustments in your offerings.

- Customer Engagement

- Communicate clearly about the billing structure, provide usage insights to customers, and offer options for plan upgrades.

Bottom line: for businesses rocking the metered billing game, a comprehensive understanding of MRR, including both fixed and variable components, is your golden ticket to making informed financial decisions, ensuring stability, and adapting to the needs of your customers.

Breaking Down The Reports

To understand the nuances of MRR and metered billing, closely analyzing specific reports within HubSpot is essential. These reports reveal the natural ebb and flow in revenue introduced by metered billing, influenced by customer behavior and usage patterns.

This insight enables businesses to grasp the dynamics contributing to MRR, facilitating informed decisions and proactive adaptation of strategies that can directly impact product usage.

Two types of reports take center stage:

Recurring Revenue Reports

This cornerstone report provides insights into the stability and predictability of MRR by encapsulating:

- Current Monthly Revenue: Outlining revenue received from subscriptions and other recurring sources, providing a clear picture of the foundational income.

- Net MRR Growth: Highlighting revenue changes from existing accounts during the period, including upgrades, downgrades, and cancelations.

Metered Billing Reports

In contrast to the predictable nature of recurring revenue, a Metered Billing Report sheds light on:

- Product Usage-Based Revenue: Exploring the data and costs linked to customer interactions, providing valuable information on usage trends, preferences, and specific factors that contribute to overall customer engagement.

- Price Adjustment Forecasting: This can affect how you approach adjusting prices based on a range of factors, including customer segmentation, seasonality, and time-sensitive promotions.

Recurring Revenue Reports and Metered Billing Reports work together to give businesses a clear financial view. They help understand current revenue and predict future trends, allowing for smart strategies that balance steady income with the dynamic nature of metered billing. This approach builds financial resilience and promotes growth.

Recording Metered Billing in MRR Reports

Example:

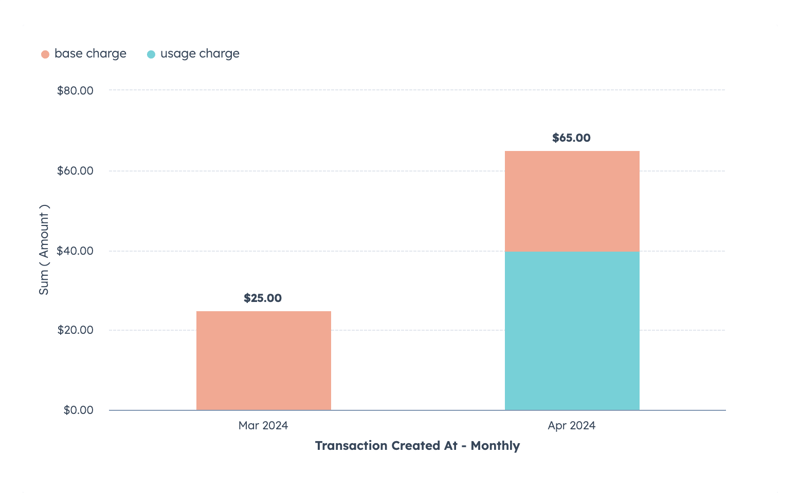

- In March, the Monthly Recurring Revenue (MRR) is $25, which is the base charge for that month.

- At the same time, we have usage charges of $40 for activities within March.

- Now, when April comes around, the base charge is still $25, but it includes the usage charges from the previous month.

So, the total MRR for April is $65 ($25 base charge for April + $40 usage charge for March).

This example highlights how crucial it is to accurately note metered billing details in MRR reports. Doing this helps clear up your finances and make smarter decisions for your business.

Emphasizing the Business Decision

Blending MRR with metered billing is a significant business decision impacting financial planning and projections. Having a clear strategy ensures accurate insights into your revenue streams, fostering informed decision-making. Avoid the chaos of blending without a plan; it's about making deliberate choices that align with your business goals.

By exploring the ins and outs of MRR and metered billing, it strategically empowers businesses to grasp their financial landscape, plan for growth, and stay agile in the ever-changing dynamics of the subscription-based economy.

With the integration of sass•hapily, HubSpot goes above and beyond its role as a mere CRM tool and becomes an invaluable partner in unraveling the complexities of usage-based billing and paving the way for sustained success.

Your Business, Your Pricing, Your Way

Explore the realm of Dynamic Pricing and elevate your business with enhanced flexibility and efficiency! If you're curious about how dynamic pricing can benefit your business, why not see it in action for yourself?

Schedule a demo with us today, and let our team help you shape the future of your pricing strategy using HubSpot's comprehensive Stripe integration. We can't wait to chat with you!